Hondasxs

Club Founder

Staff member

Lifetime Member

Supporting Member

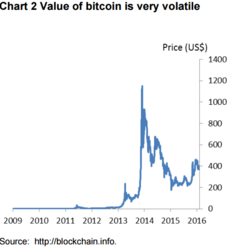

Been reading up on it hard this past week, thinking about getting in!

I should of bought. Lol.

$247 yesterday. $300 @ 9am today.

Been reading up on it hard this past week, thinking about getting in!

$247 you say... $300 a few hours later.I should of bought. Lol.

$247 yesterday. $300 @ 9am today.

Welcome, where you from? Just says US in your Avitar. What rig do u have?Hi there! I know this thread is a bit old, but it's interesting to see how the attitude toward Bitcoins and cryptos, in general, has changed over the years.

Are you thinking what I'm thinking, @Remington?Welcome, where you from? Just says US in your Avitar. What rig do u have?

Love those things, but a little hard to find...Anyone into Mallo Cup Money? You atleast get a tasty snack with every purchase